Hi ,

I have been writing for last few months and have received immense support and affection from all of you .But, I am not the only one who is writing ,there is an ocean of information out there . We search for one thing, and we get atleast 200 results . So,its important to realise that :

“Reading gives us the wisdom to take a decision ,but Data helps us to filter the right information and ensures we take right decision”.

By reading some of my articles , one would have understood that :

1. One should plan to take a term plan instead of an investment based insurance.

2.One should look at tax effective instruments to save like PPF,VPF,Tax free bonds, FMP’s ,Mutual Funds

3.One should always match the investment products to needs and not just experiment ,etc.

But:

1. Is this kind of know -how enough to take the right step towards the right direction?

2.Can any book or article publish a solution which is specific to one individual?

3. Is it necessary that what works for one person in a particular age and income group works well with another in the same age and income bracket ?

Then what can give us the impetus to take the right decision . Obviously , its one’s own data – be it financial,aspirational ,or whatever we look at it as. But it is this unique data ,which helps us to take the right decision , since our data is different from another’s.

Let me simplify this with an example .

When we purchase a phone, a gadget , a car , a house or any such personal asset which exceeds our regular household budget , there is a usual pattern we follow . We check what is our income , the regular expenses ,what is our net surplus and whether we can crunch in this EMI into our surplus .

Result , after a few months , if there is an unanticiated huge expense , we start choking . Life looks stressful and we feel burdened due to this decision. Biggest example is the home loan which we generally take.

When I ask people , why are you not saving , why is there no surplus ,comes the instant reply that I am servicing a home loan,car loan,personal loan .But these loans are going to choke us up for 5,10 or 15 years. So, does that mean that we can’t do anything about our other needs which are coming up in future?

Where did we go wrong at all , since we have checked our surplus and then only taken up the responsibility?

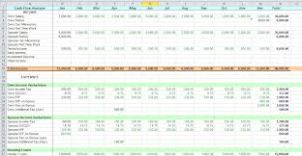

There is an answer to this . We went wrong in anticipating our cash flow correctly . We should have checked what are our requirements coming up in future. What kind of cash is required to fulfill those needs , like school joining fee 2 years down the line, school fees , parents medical emergency , anything that may come up. While its advisable to do a cash flow analysis of atleast 5 years to ensure we take right decisions, a life cash flow will be even better to take some major impactful decisions .

one may question ,How ?

Cash flow is the best way of working backwards. If we know or can anticipate our approximate inflows and outflows in future , we would be in a better position to finalise our budget ,or investments correctly for today . For e.g , it will give us clarity that we should today purchase a house within so much budget , and we will be in a position to pay so much EMI for so many years ,hence its good to go for such and such house which falls in our budget .

Does this sound good to our ears ?

So , before taking up expenses or savings , please do a cash flow for yourself . That is how Data can provide a solution which is unique to you .

If it sounds difficult , then delegate it to a financial planner or an expert to do it for you . An effort on this line today , will go a long way in saving one from the financial impact of many wrong decisions in future .

Thanks

Best regards

Deepa