Hi,

During my discussions with people day in day out about their hard earned money , the channels they use to deploy the surplus ,we come across an important discussion about real estate . It is a physical /tangible asset and automatically gives us a comfort when we buy a property as an investment . I have found people taking 90% exposure to real estate . Except a contingency fund , as and when there is a surplus ,a property is generally picked up .

One main reason for this behavior I found is the tangible nature of the asset. “We believe what we see”. Same as gold.

Second, is an assumption we have that by default, real estate appreciates . We see the value we purchased at ,and the current value . But more often than not ,we forget the number of years we hold the property for. The right way of checking is the annualised rate of return .

Its my personal opinion that a plot may be a great real estate investment ,if bought at the right kind of place , with all legalities verified and security ensured.But I have been unable to comprehend the benefit of taking an apartment as an investment option , specially if it is picked up on a loan .

There is a small attempt I have made to understand this on one of my client’s request .He asked me to check if the investment made by him is good or not.

The case history :

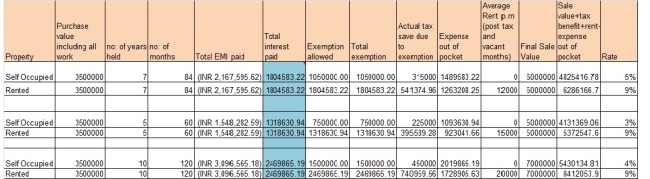

A 35 Lakh property is purchased on a loan of Rs 25 lakhs with a 11% interest for 20 years . Now its 5 years old .He gave me 3 scenarios .Selling it in 5,7 and 10 years .I tried to incorporate some details , added the tax benefit he actually gets on the exemption , reduced the excess interest paid out of our pocket from the overall sale value ,added the rental in one scenario and checked. Didn’t go into further details like repair cost and maintenance. But assuming they are on expense side, they will only reduce the rate of return is what we can infer.I found this exercise interesting and felt this information might help many .

While ,I am not too technology savvy ,but I tried to do whatever best I can . If you can work a better methodology of analyzing , please feel free to share . I am always open to learning and incorporating changes .

In the attached file, one portion is the loan amortization schedule . On the right side, I have tried to put in the purchase value , the interest payments and the close to real gain . I don’t find apartments as an investment option too great ,if we compare the hassle of maintenance , find new tenants ,ensuring timely rents etc .

Two important learnings :

1.An ideal proportion would be an exposure of 40-60% to real estate . This is including a self occupied property. Plots may be a good choice (*conditions apply) but for easy liquidity , regular appreciation and most hassle free ,are paper /financial assets ,be it in any form . Going overboard on one asset class is against the nature of diversification.

2. In real estate too, selling a property at the right time is the key to making better return . This being a physical asset, an affinity to the property does not allow us to exercise this option too often . But for best results,if we purchase a property for investment , we better treat it as one.

3. As a return on investment , rentals are nowadays not crossing 4 to 5% ( I am being too lenient) . Due to increased cost of purchase , the purchase prices have increased, but rentals have not seen a similar hike. Imagine you are trusting a huge sum of money to anybody , and in return are making 4-5% p.a , is it a happy situation ?

Compare with a tax free bond which is giving you an annual interest payment on 8.5% (All tax free) .You hold it in demat , and there is still a possibility to sell it before time through secondary market . Else ,by default ,at the end of 10,15,20 yrs ,your principal comes back to you .

Queries and questions are the best way to learn . Please feel free to write back and help me widen my knowledge bank..

Thanks

Best regards

Deepa