Hi ,

Continuing further on the topic about “Small Steps towards Tax planning “.

There are certain questions which some of you have written to me. For the benefit of everybody , would like to share them .I was asked :

- “ You always write ,every “decision” has a “financial implication “ , what does it mean and can we get an example “

- “ How does the choice of product ,impact our financials “

- And “ What should we do going forward to make better choices “

I believe, if I write to them alone, this information and knowledge may get limited to a few. Hence, I chose to write to all ,so everybody can take a tip out of this and possibly practice .

In today’s world, everybody is bombarded with so much information and options .People ,have arrived at a certain choice by trial and error and prefer to stick to them .

As a Financial Planner , there are three most important objectives I work on :

With the knowledge , experience and expertise I have gained through my work, I should help and advice my clients to choose options :

- which are most tax effective

- Which are not expensive .

- Which are not against their nature and risk appetite.

Keeping this in mind, I would like to demonstrate the solution to above questions with the help of an example. A general practice with all of us , is that when we accumulate certain surplus in our account , we move them into fixed deposits to earn better interest .

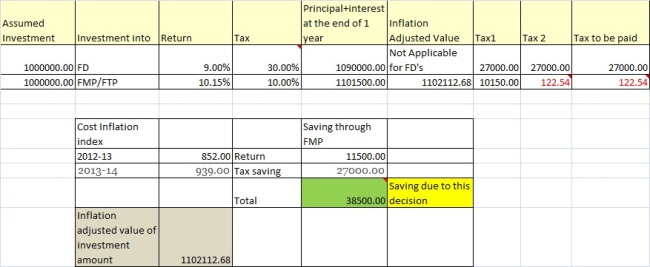

I am going to consider an alternative to this ,which is called FMP/FTP,i.e.,Fixed Maturity Plans or Fixed Term Plans. These are mutual funds,which invest into Certificate of Deposits and Government Sovereign . Some FMP’s also invest a certain portion into commercial papers issued by Corporates with safe ratings. For the sake of simplicity in comparison, I am going to compare the FD with FMP (which invests into CD’s and Sovereign alone) of >366 days Maturity.

Assume that we have Rs 10 lakhs with us, and are trying to decide which option to go for .We need the funds coming year for an expense.

(Also attaching an excel ,where changes can be made to the investment amount and impact verified.)

The difference is that

1.while FD’s have a good rate of return, They are taxed at Slab of an Individual. A person in 30% slab ends up paying 30% tax.

2.FMP’s give us an option of paying either 10% tax on gain without indexation or 20% with indexation. Indexation is nothing but adjusting inflation to the investment value and understanding what is the real return we made.

In the attached example ,I have considered the cost inflation for 2012-13 and 2013-14(can be verified from below link on cost inflation index chart) . An investment done in 2012-13 for Rs 10 lakhs ,is equivalent to 11.02 lakhs due to the inflation. The gain we made is only 11.015 lakhs which indicates that our real return is negative 612 Rs . Tax authorities give us the freedom to choose to pay the tax which is least of the two options . So we pay nil taxes and stand to gain approx. Rs 38500 by making this decision.

http://cadiary.org/cost-inflation-index-capital-gain/

So only one decision on a product choice has saved us Rs 38500 which could be deployed further towards our financial responsibilities . This is only an impact of one decision that we take. Imagine if we take such informed decisions every time and save in a structured manner , the money can benefit us more ,than sitting in Taxman’s account .

So I have answered the first two questions. Now,to answer the third question:

If there is time and expertise available ,please make thoughtful choices when saving money . Do not underestimate the power of even 1% .Lets read and understand all the key points before making decisions and I am sure informed choices always stand to our benefit.

If there is no time left after attending to our core job responsibilities, one may seek assistance from somebody who has the expertise and knowledge to do the verification on your behalf and guide you to make informed choices .

Thanks

Best Regards

Deepa