Hi ,

The new year has started on a great positive note . There are many who have come forward asking me for a discussion about their personal finance . They have clearly demonstrated that its time to set aside all inhibitions and check and audit on what is the current status . The questions which come up might be regular like the ones below , solutions may be varying from individual to individual.

“Are we in the right direction”.

“What are the corrections to bring our finance to the right track”.

“What is the right course of action to be followed in future”.

And the big question “ Where to Save and How much “.

During these interesting conversations , I have observed a few common points . I am sharing in this forum since I know that all of us are sailing in the same boat and these thoughts may have crossed our mind some time .

a) Every one of us want to save ,might be little or more ,but intent is to save. (Who doesn’t want to ?)

b) Saving according to us is, being able to leave a residue from income ,post spending for all our requirements .

c) There are two hidden personalities within us which control our financial decisions at different times.

1) When we see an amount accumulating in our regular savings account, our first personality takes over and gives us a sense of satisfaction and security. We treat this as our contingency , and higher the accumulation ,the better is our feeling.

2) When the accumulation gets beyond acceptable limits , we now decide that its time to invest our money . But, when we deploy , we want the money to give us the highest returns possible . Our conscience tells us that all this money was sitting idle till now,so we better get things moving quickly. This is similar to the last minute exam preparation where we want to score highest with minimum preparation. This zeal of earning highest return pulls us towards aggressive products or complicated products .We check with friends and colleagues and decide to go ahead with one which gets maximum votes.

3) Even when it comes to investing into mutual funds, our concentration is only on equity mutual funds and the ones which generate maximum returns . Do we really take time out to research what are the risk parameters and how to compare funds based on risk and return together?

The outcome is mismatch of expectations and picking up products which do not match our needs . As a result we have bad experiences and we conclude that its best to stick to our traditional avenues of investing , i.e., FD,Real Estate and Gold and back to square 1.

Are we being fair to our money ?Are we not missing out the key link in all the above observations?

Yes, we are !!

The root cause of all the above is “ Not Being Disciplined with our money,with our savings and not being in tune with our real priorities. “ Again , all of us want to be disciplined with savings .Then what goes wrong. Simple, its never on our hit list ( priority list) because its not our emergency item. We are tuned to living in an urgent and important /unimportant square, that unless something is urgent ,we don’t do it.

Let me share a tip which I follow with my clients which might be of help.

1 . I first help them identify their responsibilities for which they need to save .

2. Then I identify how much is to be saved .

3.Finally , I help them automate all the savings in such a way that money flows out of their account before 5th of every month into the various baskets of saving . Automation is the best solution to being disciplined with money . If one is able to identify where to save and how much to save, this is the best way to make money work for us.

One may ask , why should we put our money to use at all in the first place. We are comfortable seeing it lie the way it is .

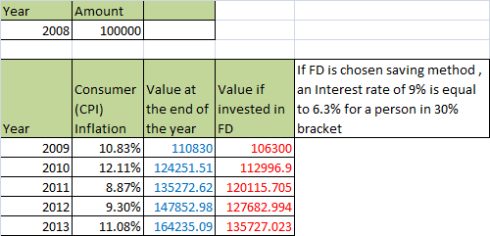

While we may not really want to take the pain , but without our knowledge , inflation is working its way ahead like a rabbit. Find below in the attachment , the CPI ( consumer inflation) figures for last 5 years . What we could purchase for Rs 1 lakh in 2008 , how much do we shell out in every consecutive year . I have also taken an example of a person in 30% tax bracket , saving in FD for these years with an assumed rate of return as 9% . You will observe that if we do not save judiciously , we will end up working harder to preserve the value of our money and contributing more towards living expenses itself. Imagine if we haven’t used even FD as saving mechanism, then what could be the implication !!

So, better late than never , pick up the pace and beat the inflation monster !!

Thanks

Best regards

Deepa